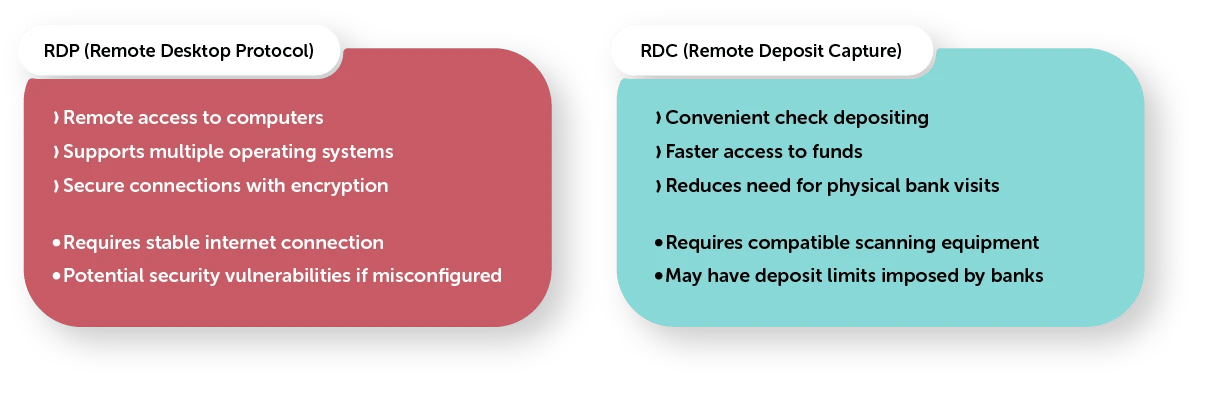

In today's digital age, remote access has become increasingly important for businesses and individuals alike. Two popular remote access technologies are Remote Deposit Capture (RDC) and Remote Desktop Protocol (RDP). Although they serve different purposes, understanding the differences between RDC vs RDP can help determine which option is the better choice for your specific needs.

What is Remote Deposit Capture (RDC)?

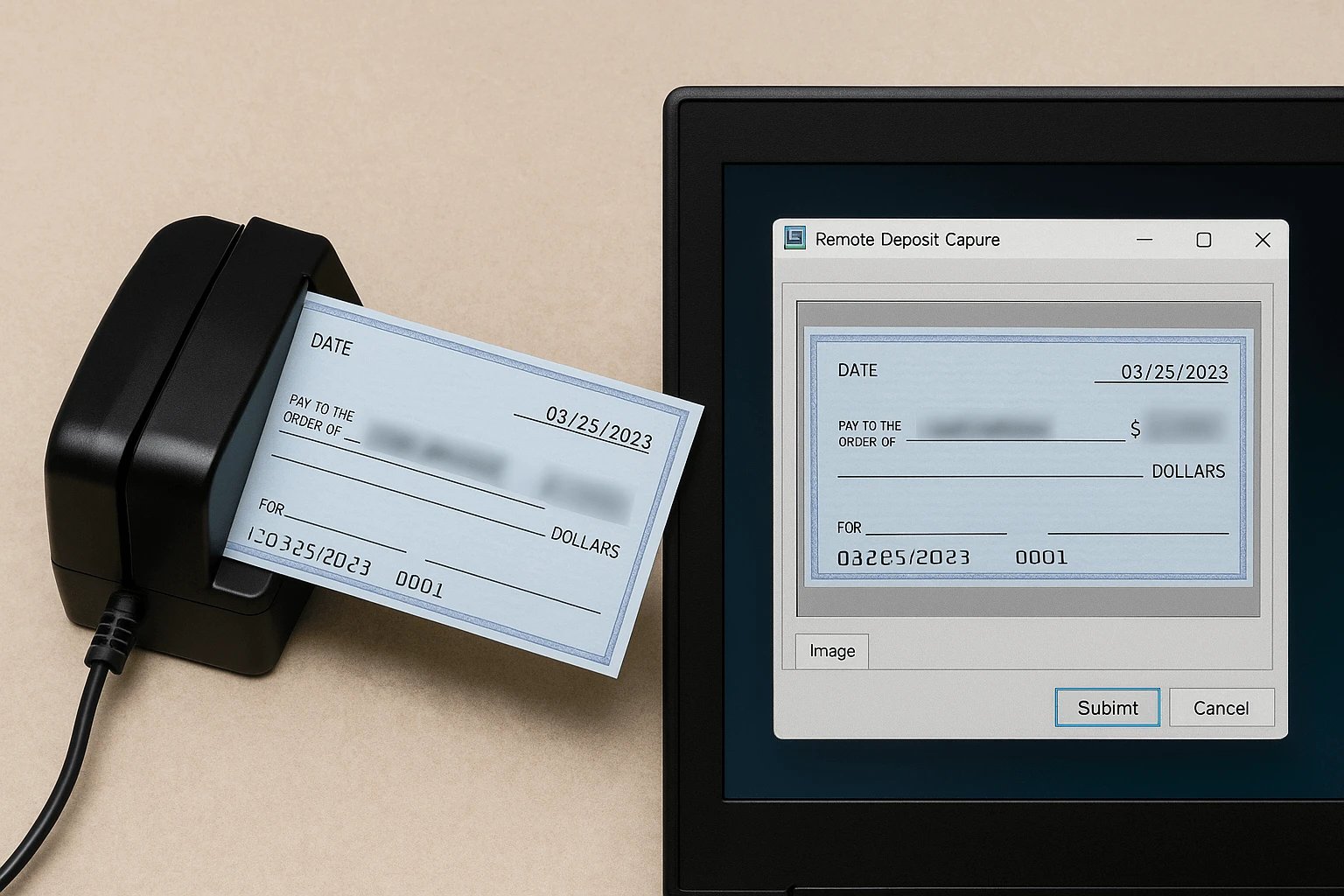

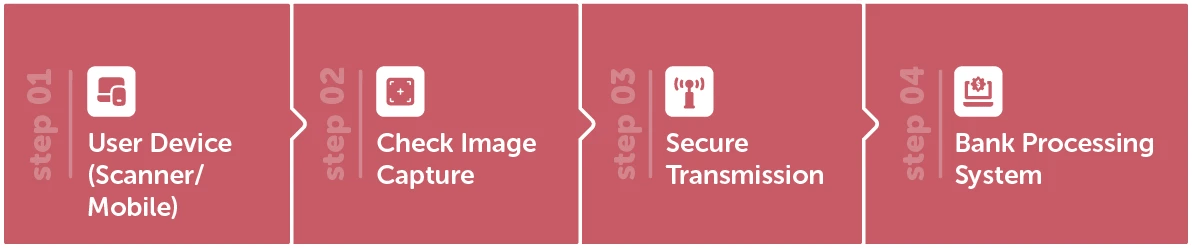

Remote Deposit Capture, or RDC, is a technology that enables individuals and businesses to deposit checks remotely without physically visiting a bank branch. It allows users to capture check images using a scanner or a mobile device and then transmit the images securely to their bank for deposit. RDC simplifies the check deposit process and offers convenience, especially for those who receive a large volume of checks regularly.

Advantages of RDC:

- Convenience: RDC eliminates the need to visit a bank branch, saving time and effort for businesses and individuals.

- Faster access to funds: By depositing checks remotely, funds are made available more quickly, enhancing cash flow.

- Improved accuracy: RDC systems often have built-in features to automatically validate check amounts, reducing the chances of human errors.

- Cost savings: RDC eliminates transportation costs associated with physically depositing checks at a bank branch.

Disadvantages of RDC:

- Equipment requirements: RDC requires compatible scanning devices or mobile apps, which may involve additional costs.

- Security concerns: Transmitting check images remotely raises security considerations, as there is a potential risk of interception or unauthorized access.

- Potential deposit limits: Some banks may impose daily or monthly deposit limits for RDC transactions, which could be a constraint for businesses with higher check volumes.

What is Remote Desktop Protocol (RDP)?

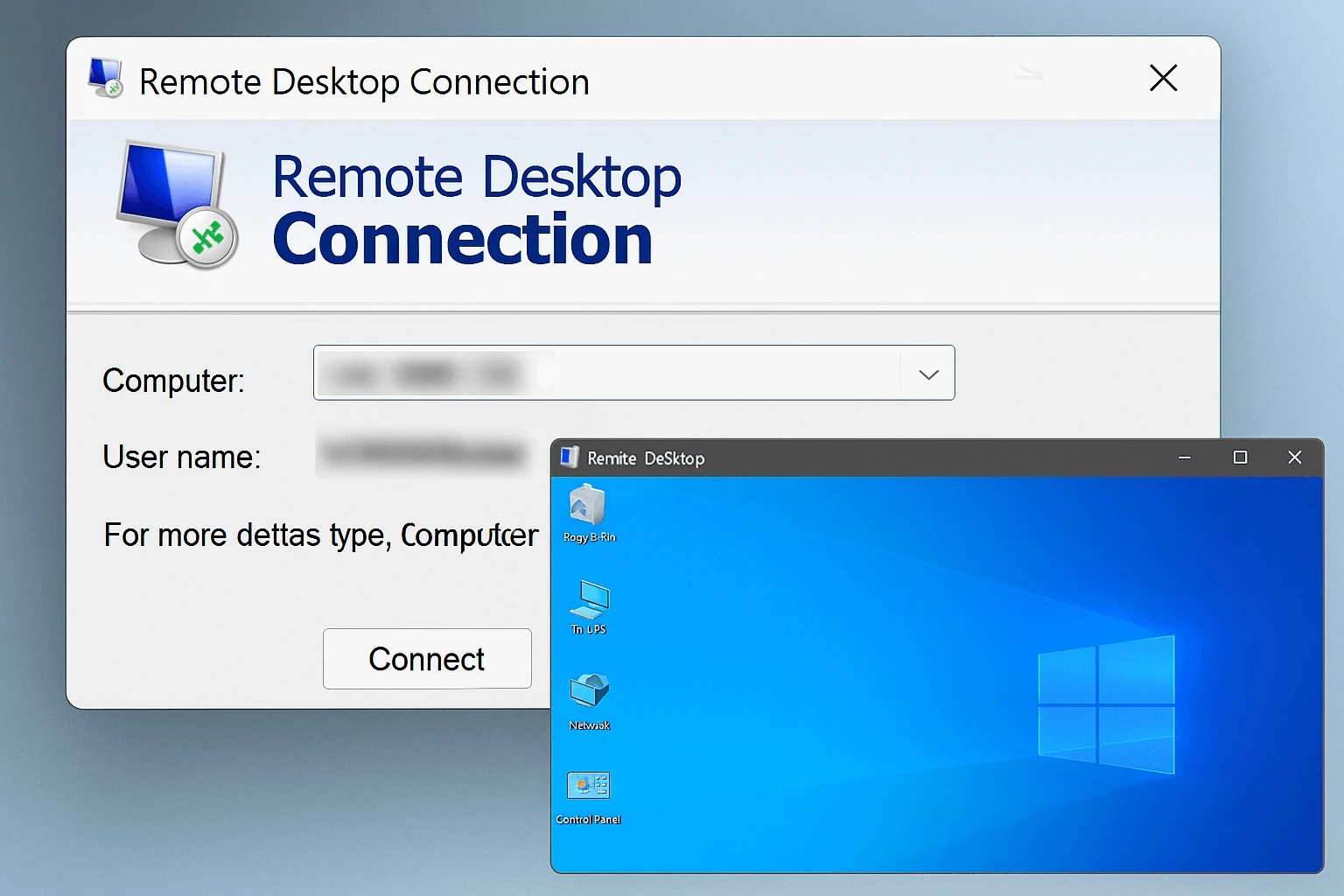

Remote Desktop Protocol, or RDP, is a proprietary protocol developed by Microsoft that allows users to connect to a remote computer or server and control it as if they were physically present at the machine. RDP microsoft provides a virtual desktop experience, enabling users to access files, applications, and network resources on a remote system. If you're interested in learning more about RDP, take a look at our article titled "What is a Remote Desktop Protocol (RDP) Client?" You'll discover valuable information within it.

Advantages of RDP:

- Accessibility: RDP allows users to access their remote systems from anywhere with an internet connection, providing flexibility and mobility.

- Collaboration: RDP facilitates remote collaboration by enabling multiple users to connect to the same remote system simultaneously.

- Enhanced security: RDP supports encryption and network-level authentication, ensuring secure remote access.

- Centralized management: RDP allows IT administrators to remotely manage and troubleshoot systems without physical access, reducing maintenance costs.

Disadvantages of RDP:

- Bandwidth requirements: RDP sessions require a stable and sufficient internet connection, particularly for resource-intensive applications.

- Limited graphical performance: RDP may not provide the same level of graphical performance as a local system, making it less suitable for graphic-intensive tasks.

- Compatibility: RDP is primarily designed for Windows operating systems, limiting its compatibility with other platforms.

Difference between RDP and RDC:

The main difference between RDP and RDC lies in their purpose and functionality. RDC is specifically designed for remote check depositing, enabling users to electronically transmit check images to their bank for processing. On the other hand, RDP is focused on remote access and control of computers or servers, allowing users to operate a remote system as if they were physically present.

|

Feature |

RDP (Remote Desktop Protocol) |

RDC (Remote Deposit Capture) |

|

Purpose |

Remote access to computers |

Remote check depositing |

|

Developed by |

Microsoft |

Banking institutions |

|

User Interface |

Graphical desktop |

Scanning interface |

|

Primary Use Case |

IT support, remote work |

Financial transactions |

|

Security |

Encryption, authentication |

Secure transmission |

|

Required Equipment |

Computer, internet connection |

Scanner or mobile device |

|

Operating Systems |

Windows, macOS, Linux |

Varies by bank |

Which one is better: RDC or RDP Account?

Determining which option is better, RDC or RDP Account, depends on your specific requirements. If your primary need is to deposit checks remotely, RDC is the ideal choice as it streamlines the check deposit process, saves time, and provides faster access to funds. However, if you require full remote access and control of a computer or server, RDP is the better option as it offers a virtual desktop experience, enabling you to access files, applications, and network resources from anywhere.

1Gbits is a leading provider of remote connectivity solutions, offering RDP and RDC Servers. With a wide range of services and a commitment to excellence, 1Gbits is dedicated to meeting the diverse needs of its customers in the remote connectivity domain. Check our RDP service and Buy RDP now to find the ideal solution for your remote connectivity needs- Unparalleled Security and Lightning-Fast Speeds Await You!

Final Words

In conclusion, both RDC vs RDP are valuable remote access technologies that serve different purposes. RDC is ideal for remote check depositing, while RDP is suitable for remote computer access and control. Assessing your needs and priorities will help you determine which option, RDC or RDP, is the better choice for your specific situation.