Forex algorithmic trading is essentially an automated trading system where the use of computer programs is involved to analyse the market and execute trades based on a set of rules. This practice saves time and effort compared to placing trades manually. The forex market operates around the clock and is very responsive to data; more and more traders are relying on algorithms to eliminate emotional decision-making, enhance consistency, and exploit the market opportunities that human traders cannot react to quickly enough.

In this guide, you are going to discover the true nature of forex algorithmic trading, its working process, the major strategies and trading bots, risks and limitations, and last but not least, the requirements for constructing and operating a full-fledged algorithmic forex trading system in the year 2025.

If you’re new to the forex market and want a quick overview of how currency trading works before diving into automation, check out our guide on Forex Trading for Beginners.

🤖 What Is Forex Algorithmic Trading?

What is forex algorithmic trading? It is a method of trading where computer algorithms automatically analyze price data and execute trades based on predefined rules, without manual intervention. The core idea is simple: replace human judgment with logic, data, and repeatable execution.

|

Aspect |

Manual Forex Trading |

Forex Algorithmic Trading |

|

Decision-making |

Human analysis and intuition |

Rule-based algorithms |

|

Emotional influence |

High (fear, greed, hesitation) |

None |

|

Execution speed |

Slow to moderate |

Extremely fast (milliseconds) |

|

Consistency |

Varies by trader |

Fully consistent |

|

Market monitoring |

Limited by human time |

24/5 continuous monitoring |

|

Scalability |

Difficult to scale |

Easily scalable across pairs |

What this really means is that forex algorithmic trading focuses on discipline and execution rather than prediction. Compared to manual trading, it’s designed to reduce mistakes caused by emotions and missed opportunities, while relying entirely on how well the strategy itself is built.

To understand exactly how a VPS enhances trading performance, read What is Forex VPS for a deeper breakdown.

⚙️ What Is Algo Trading in Forex?

What is algo trading in forex? It refers to using automated algorithms that follow predefined rules to decide when to enter, manage, and exit trades based on market data. These rules can be built from technical indicators, price action, time conditions, or statistical models.

|

Factor |

Algorithmic Decision-Making |

Human Decision-Making |

|

Basis of action |

Predefined rules and logic |

Emotions, experience, intuition |

|

Reaction speed |

Instant, machine-level |

Delayed, human-limited |

|

Emotional bias |

None |

High under pressure |

|

Rule consistency |

Always identical |

Often inconsistent |

|

Risk discipline |

Enforced by code |

Easily overridden |

The key advantage of algo trading in forex is emotional neutrality, especially during volatile market conditions. Instead of reacting to fear or greed, the algorithm executes exactly what it was designed to do, trade after trade.

🔄 How Forex Algorithmic Trading Works

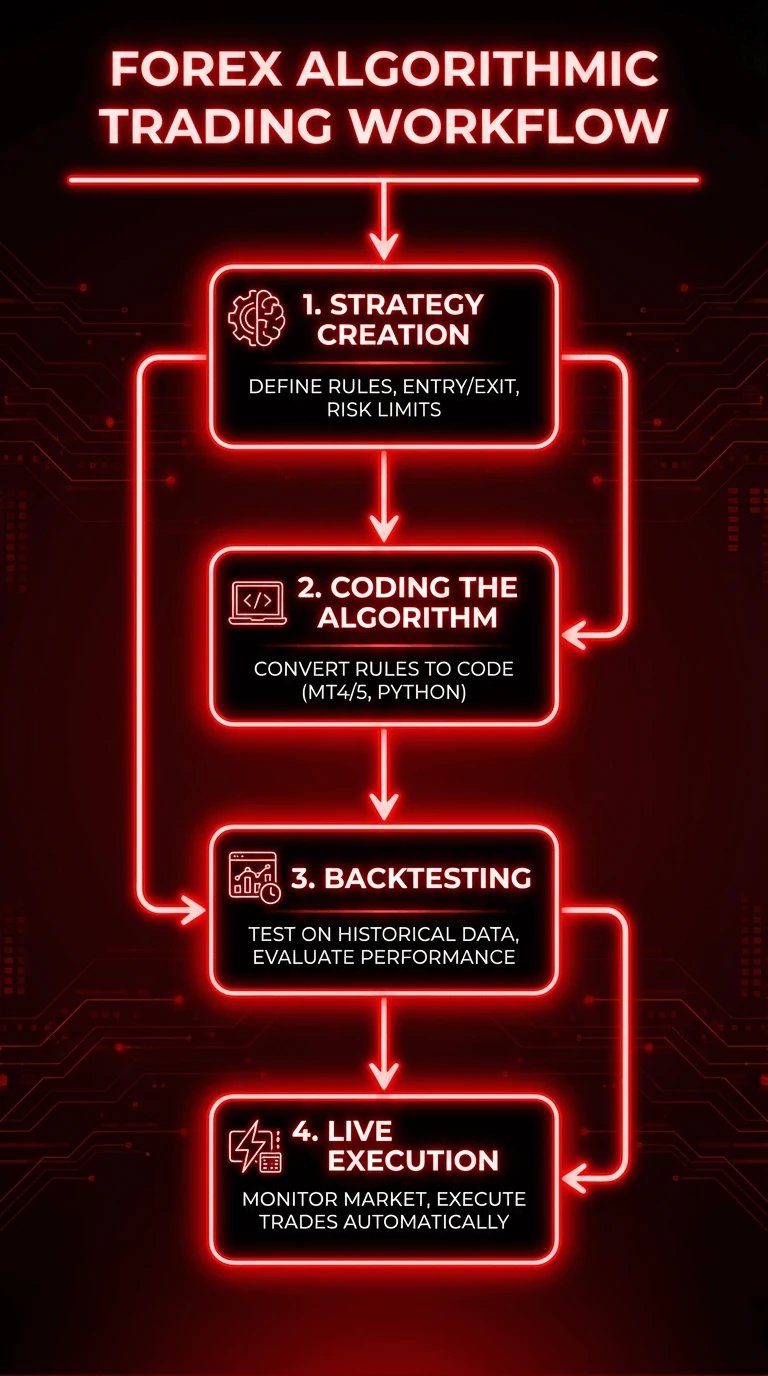

Forex algorithmic trading works as a structured, repeatable process where trading ideas are transformed into executable code and tested before risking real capital. Instead of guessing market direction, every decision is defined in advance and executed automatically.

-

Strategy creation: The trader defines clear trading rules such as entry conditions, exit logic, position sizing, and risk limits based on a specific market behavior.

-

Coding the algorithm: These rules are converted into code using platforms like MT4, MT5, cTrader, or programming languages such as Python, so the system can act without manual input.

-

Backtesting: The algorithm is tested on historical market data to evaluate performance, drawdowns, win rates, and weaknesses before going live.

-

Live execution: Once validated, the algorithm runs in real-time, monitoring the market and executing trades automatically based on live price data.

What matters most here is that each step builds on the previous one; skipping or rushing any stage usually leads to unreliable results. A well-structured workflow is what separates sustainable forex algorithmic trading systems from short-lived experiments.

📈 Forex Algorithmic Trading Strategies

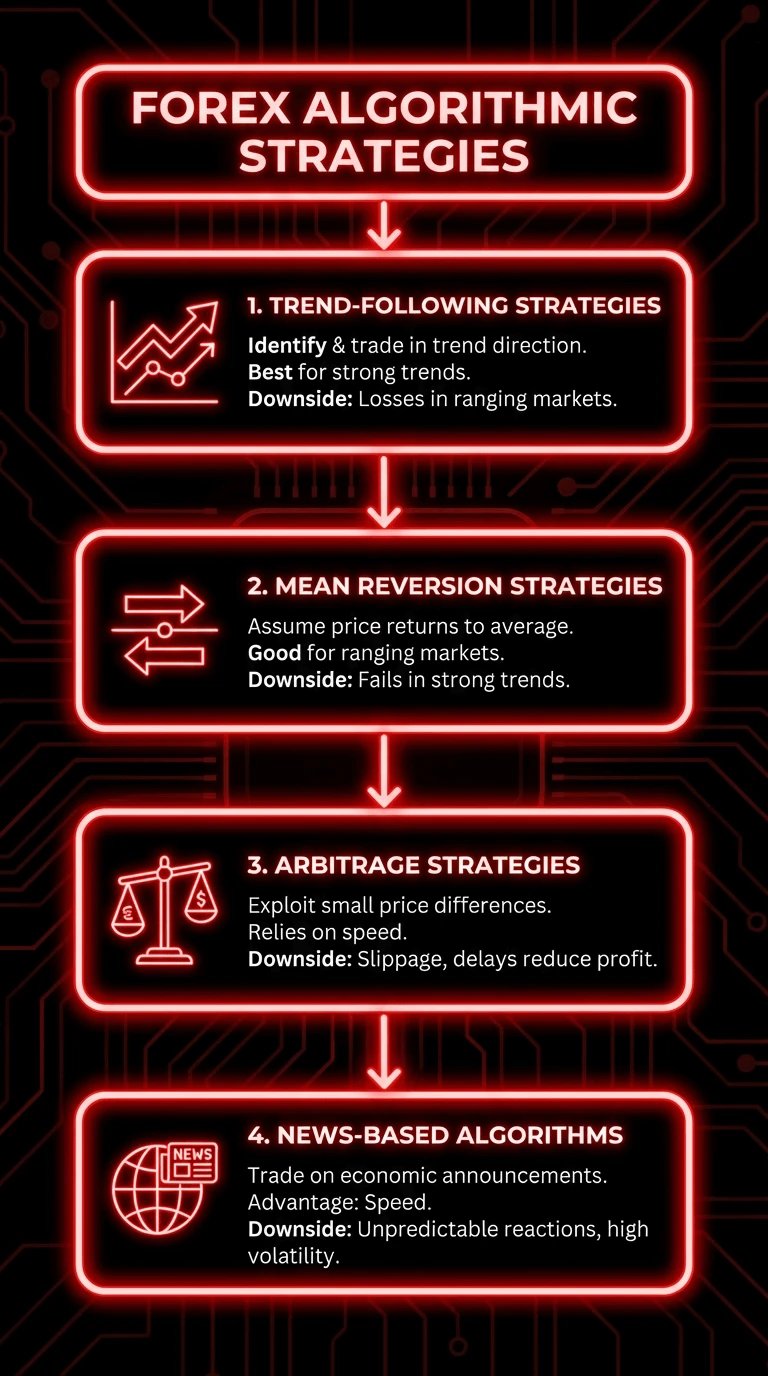

Forex algorithmic trading strategies define the logic an algorithm follows to identify trading opportunities and manage risk. Each strategy is designed to exploit a specific type of market behavior, not to work in all conditions.

📊 Trend-Following Strategies

Trend-following strategies aim to identify and trade in the direction of an established market trend using indicators such as moving averages or breakout levels. These strategies work best in strong, directional markets and are widely used in forex algorithmic trading strategies due to their simplicity. The downside is that they often suffer losses during ranging or choppy market conditions.

🔁 Mean Reversion Strategies

Mean reversion strategies assume that the price will return to its historical average after moving too far in one direction. They are commonly applied in range-bound markets and can produce frequent, smaller profits when volatility is controlled. However, they can fail badly during strong trends where the price does not revert as expected.

⚖️ Arbitrage Strategies

Arbitrage strategies attempt to exploit small price differences between currency pairs, brokers, or correlated instruments. These strategies rely heavily on execution speed and low latency, making infrastructure a key factor. While risk can be low in theory, real-world costs such as slippage and delays often reduce profitability.

📰 News-Based Algorithms

News-based algorithms trade around economic announcements by reacting instantly to data releases such as interest rates or inflation reports. Their main advantage is speed, as algorithms can act faster than human traders when volatility spikes. The risk lies in unpredictable market reactions, widening spreads, and execution delays during high-impact events.

🧩 Complete Algorithmic Forex Trading and Backtesting System

A complete algorithmic forex trading system follows a clear pipeline: strategy design, market data collection, backtesting, optimization, and live deployment. High-quality historical data is critical because inaccurate pricing, missing candles, or incorrect spreads can completely distort backtesting results. Common mistakes include overfitting strategies to past data, ignoring trading costs, and assuming perfect order execution that never exists in live markets.

🤖 Forex Automated Trading Bot Explained

A forex automated trading bot is a software program that executes trades automatically based on a predefined algorithm or strategy. These bots continuously monitor the market, calculate signals, and place orders without human intervention. Their effectiveness depends entirely on the quality of the strategy, risk management rules, and execution environment.

For a full setup guide, see Setup a VPS for Forex Robot Trading, which walks you through running your bot securely and efficiently.

🧠 Forex Algo Trading Software & Robots

Forex algo trading software and robots provide the technical foundation for building, testing, and running automated strategies. The right tools depend on the trader’s skill level, customization needs, and infrastructure setup. Choosing poorly often leads to execution issues or unrealistic performance expectations.

For a complete overview of how trading robots function and how to build your own, visit What is a Forex Trading Robot.

💻 Forex Algo Trading Software

Popular forex algo trading software platforms include MT4, MT5, cTrader, and Python-based frameworks. MT4 and MT5 are widely used for their built-in strategy testers and large ecosystem, while cTrader offers advanced order handling. Python-based systems provide maximum flexibility but require stronger programming and data management skills.

🤖 Forex Algo Trading Robot

Forex algo trading robots can be prebuilt solutions or fully custom systems developed for a specific strategy. Prebuilt robots are easy to deploy but rarely adapt well to changing market conditions, while custom robots offer better control and long-term flexibility. Claims of guaranteed profit are a major red flag, as no algorithm can eliminate risk or market uncertainty.

🏆 Best Algo Trading Software for Forex

Choosing the right platform can make a significant difference in how effectively you implement and manage your automated strategies. The best algo trading software for Forex should balance flexibility, execution reliability, and ease of use.

|

Platform |

Flexibility |

Cost |

Skill Level Required |

Key Strength |

|

MT4 |

Medium |

Low |

Beginner, Intermediate |

Large community & indicators |

|

MT5 |

High |

Low |

Intermediate |

Multi-asset support & advanced tester |

|

cTrader |

High |

Medium |

Intermediate |

Fast execution & algo features |

|

Python Frameworks |

Very High |

Free/Open-source |

Advanced |

Custom models & data control |

|

Proprietary APIs (Broker) |

Variable |

Varies |

Intermediate, Advanced |

Direct broker integration |

The best choice depends on your individual needs, such as whether you want simplicity or full custom control. Regardless of platform, understanding how it handles order execution, data feeds, and backtesting is essential before risking capital.

To compare the two most popular platforms in detail, check out MT4 vs MT5.

📊 Does Algorithmic Trading Work in Forex?

Does algorithmic trading work in forex? Data shows that well-designed algorithms can perform consistently when they are matched to the right market conditions and supported by proper risk management. However, algorithmic systems often fail during regime changes, low-liquidity periods, or unexpected macroeconomic shocks where historical patterns break down.

💰 Can You Make Money With Algorithmic Trading?

Can you make money with algorithmic trading? Yes, but returns are typically uneven and come with drawdowns that many traders underestimate. Realistic expectations involve steady performance over time, strict risk control, and acceptance that losing periods are an unavoidable part of algorithmic forex trading.

🖥️ Infrastructure Matters

In forex algorithmic trading, infrastructure is not a technical detail; it directly impacts profitability and system stability. Even a strong strategy can fail if execution is slow, unreliable, or frequently interrupted.

-

Latency: Delays of even a few milliseconds can cause slippage, missed entries, or worse fills, especially for high-frequency or scalping algorithms.

-

Uptime: Algorithms must run 24/5 without interruptions; local power cuts or internet issues can shut down trading instantly.

-

Execution speed: Faster order routing improves fill quality and reduces deviation from backtested results.

-

Why VPS matters: A dedicated Forex VPS keeps your algorithms running close to broker servers with stable connectivity and low ping.

This is why professional algo traders rely on VPS infrastructure instead of home computers. Using a reliable, low-latency environment is often the difference between a strategy that works on paper and one that survives in live markets.

Learn more about why professional traders depend on VPS servers in Why VPS Is Used in Forex Trading

❌ Common Mistakes in Forex Algorithmic Trading

Most failures in forex algorithmic trading come from design and execution errors, not from the idea itself. These mistakes are common even among technically skilled traders.

-

Overfitting: Optimizing a strategy too heavily on historical data until it performs well in the past but fails live.

-

No risk management: Algorithms that lack position sizing, stop-loss rules, or drawdown limits eventually blow up accounts.

-

Ignoring execution latency: Assuming perfect fills without accounting for slippage, spread widening, or order delays.

-

Blind trust in robots: Relying on black-box systems without understanding how or why they trade.

Avoiding these mistakes requires discipline, testing realism, and constant monitoring. Successful algorithmic trading is a process, not a one-time setup.

⚖️ Forex Algorithmic Trading vs Manual Trading

Forex algorithmic trading and manual trading serve different purposes depending on the trader’s goals, skills, and resources. Neither approach is universally better; each has clear strengths and limitations.

|

Aspect |

Algorithmic Trading |

Manual Trading |

|

Execution speed |

Extremely fast |

Limited by human reaction |

|

Emotional influence |

None |

High |

|

Consistency |

Fully rule-based |

Varies by trader |

|

Flexibility |

Needs re-coding |

Instant decision changes |

|

Time requirement |

Low after setup |

High, constant attention |

|

Scalability |

Easy to scale |

Difficult to scale |

Algorithmic trading makes sense for traders who value consistency, automation, and data-driven execution. Manual trading is often better for discretionary strategies, news interpretation, or traders who prefer full control over every decision.

✅ Conclusion

Forex algorithmic trading is not the same as choosing the easy way to get profits straightaway. It is a method that is structured and based on the analysis of data. Emotional decisions have been replaced by logic, testing, and disciplined execution. Provided that the strategies are realistic, backtesting is done correctly, and risk is controlled, algorithms may consistently operate through different market conditions, but only if they are supported by the infrastructure. Stable uptime, low latency, and reliable execution are not just optional extras but are among the requirements made by any serious algo trader.

Run your algorithms on a high-performance Forex VPS from 1Gbits with instant setup, 24/7 support, and data centers close to major brokers.

![What Is Cold Data Storage? ❄️ [2026 Guide] What Is Cold Data Storage? ❄️ [2026 Guide]](https://1gbits.com/cdn-cgi/image//https://s3.1gbits.com/blog/2026/02/what-is-cold-data-storage-750xAuto.webp)

![What Is Virtual Desktop Infrastructure? 🖥️ [VDI Explained] What Is Virtual Desktop Infrastructure? 🖥️ [VDI Explained]](https://1gbits.com/cdn-cgi/image//https://s3.1gbits.com/blog/2026/02/what-is-virtual-desktop-infrastructure-vdi-750xAuto.webp)