For traders deciding between MT4 and MT5, understanding the key differences and practical implications is essential. Whether you are a beginner in forex trading or an experienced investor looking to diversify into stocks, commodities, and futures, knowing the MetaTrader platform differences can save time, optimize strategies, and improve trading outcomes.

This MetaTrader 4 vs MetaTrader 5 comparison will provide a comprehensive overview, including trading features, technical architecture, broker compatibility, migration advice, and real-world user scenarios.

Both MT4 and MT5 are powerful platforms developed by MetaQuotes, each catering to different trader needs. MT4 has long been favored for its simplicity and focus on forex trading, while MT5 offers more advanced tools, multi-asset support, and enhanced performance. By exploring MT4 vs MT5, you will gain clarity on MT4 or MT5 which is better for your trading goals.

Feature Comparison Table

|

Feature |

MetaTrader 4 (MT4) |

MetaTrader 5 (MT5) |

Practical Implications |

|

Release Year |

2005 |

2010 |

MT5 is newer and designed for multi-asset trading |

|

Market Access |

Forex, limited CFDs |

Forex, stocks, commodities, futures, CFDs |

MT5 supports more diverse trading opportunities |

|

Order Types |

4 pending orders (Buy Stop, Sell Stop, Buy Limit, Sell Limit) |

6 pending orders (+ Buy Stop Limit, Sell Stop Limit) |

MT5 allows more complex entry strategies |

|

Hedging / Netting |

Hedging only |

Hedging and Netting |

MT5 supports both stock/futures style netting and forex hedging |

|

Timeframes |

9 |

21 |

MT5 provides more granular technical analysis |

|

Technical Indicators |

30 built-in, 24 graphical objects |

38 built-in, 44 graphical objects |

MT5 offers extra tools for advanced traders |

|

Automated Trading |

MQL4, Expert Advisors |

MQL5, Expert Advisors |

MT5 allows more sophisticated EAs and multi-asset strategies |

|

Multi-Currency Strategy Testing |

Single-threaded |

Multi-threaded |

MT5 enables faster and more advanced backtesting |

|

Platform Support |

Desktop, mobile, web |

Desktop, mobile, web |

Both platforms offer cross-device flexibility |

|

Broker Support |

Almost all brokers |

Growing, fewer brokers than MT4 |

Check availability before migrating |

|

Community & Resources |

Large, established |

Smaller but growing |

MT4 remains stronger for beginner guidance |

This table highlights the essential MetaTrader platform differences. Below, we will explore each category in detail to help traders make informed decisions about MT4 or MT5 which is better for them.

Overview of MT4 and MT5 Platforms

MetaTrader 4 (MT4) is a forex-focused trading platform launched in 2005. It offers a simple interface, real-time market data, powerful charting tools, and automated trading through Expert Advisors (EAs). MT4 is compatible with most brokers worldwide and available on desktop, mobile, and web.

Its long-standing popularity has built a large community with abundant educational resources, making it ideal for beginners. For more details on MT4, you can check What is MetaTrader4.

MetaTrader 5 (MT5) was released in 2010 as a multi-asset trading platform. While retaining core features of MT4, MT5 adds more order types, more timeframes, multi-threaded strategy testing, support for stocks, commodities, futures, and cryptocurrencies, and an advanced programming language (MQL5).

Both platforms share core functionalities like real-time market access, technical indicators, and automated trading. Choosing between MT4 vs MT5 largely depends on whether you prioritize simplicity, advanced trading tools, or multi-asset access.

Key Differences Between MT4 and MT5

Trading Features and Order Types

Order types and trading flexibility are key considerations:

-

MT4 supports 4 pending orders (Buy Stop, Sell Stop, Buy Limit, Sell Limit) and hedging. Its order types suit straightforward forex strategies.

-

MT5 expands pending orders to 6, adding Buy Stop Limit and Sell Stop Limit, providing traders with more control in volatile markets.

-

Hedging vs Netting: MT4 supports hedging only. MT5 supports both hedging and netting, making it versatile for stock and futures traders.

-

Depth of Market (DOM): MT5 provides DOM data for seeing buy and sell volume at each price level, which MT4 does not. This is useful for active traders managing multiple positions.

Traders who focus solely on forex may find MT4 sufficient, while those using multi-asset strategies benefit from MT5 features vs MT4.

Technical Architecture and Programming

The platform architecture and programming language are critical for automated trading:

-

MT4 uses MQL4, which is suitable for creating forex-focused EAs and custom indicators. Single-threaded backtesting can limit performance with complex strategies.

-

MT5 uses MQL5, an object-oriented language supporting advanced EAs, multi-asset strategies, and multi-threaded backtesting. Traders can simulate multiple currencies or assets simultaneously, improving efficiency and strategy optimization.

-

MT5’s architecture is designed for multi-asset trading, whereas MT4 is optimized for forex. This affects server handling, trade execution, and data integration.

For algorithmic traders, MT5 provides significant advantages in complexity and speed.

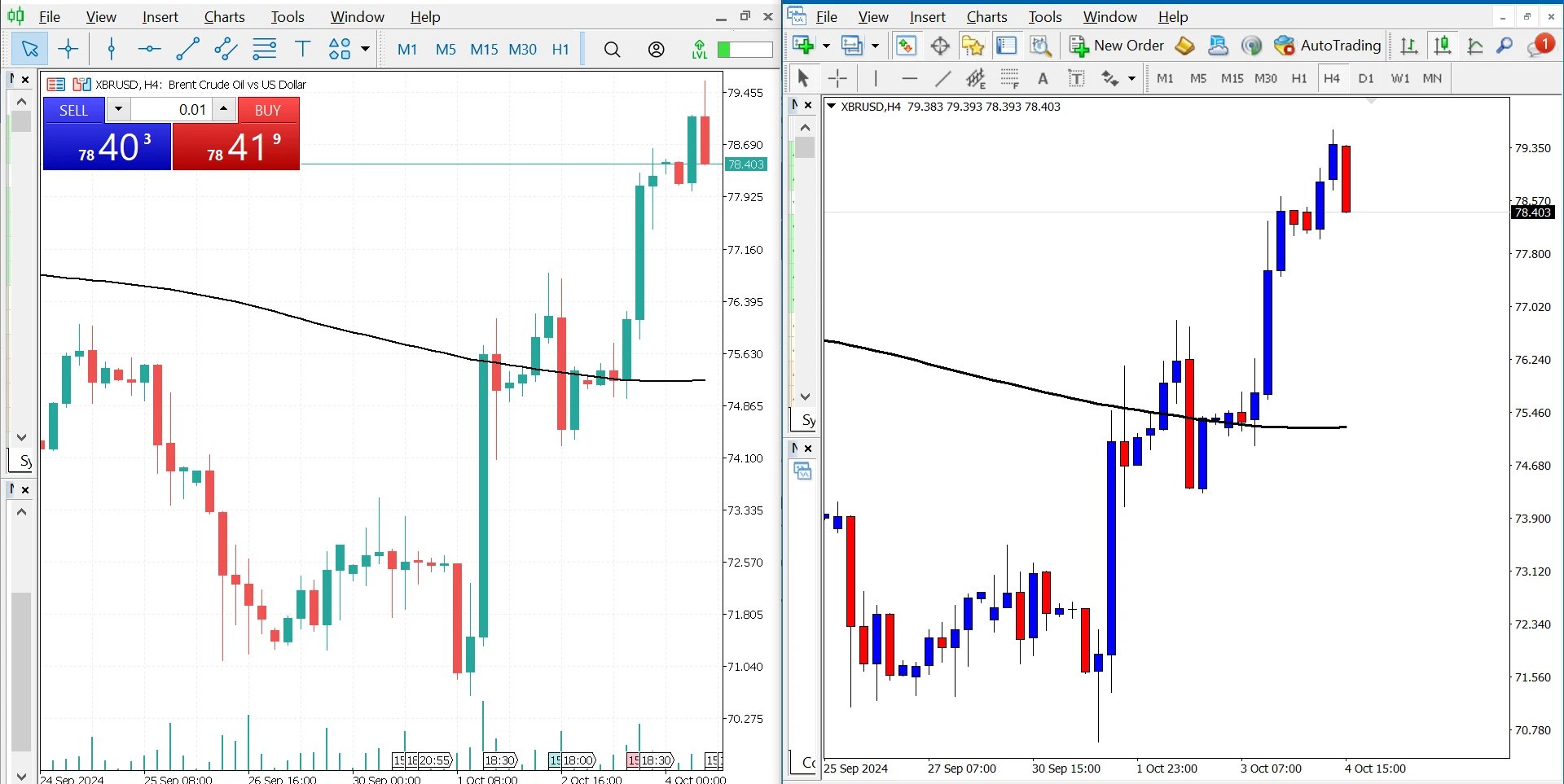

Available Timeframes and Indicators

Technical analysis relies on timeframes and indicators:

-

MT4: 9 timeframes (1 minute to 1 month), 30 indicators, 24 graphical objects.

-

MT5: 21 timeframes, 38 indicators, 44 graphical objects, and the ability to overlay multiple charts on one screen.

Advanced traders or those analyzing multiple instruments simultaneously will benefit from MT5’s extended capabilities.

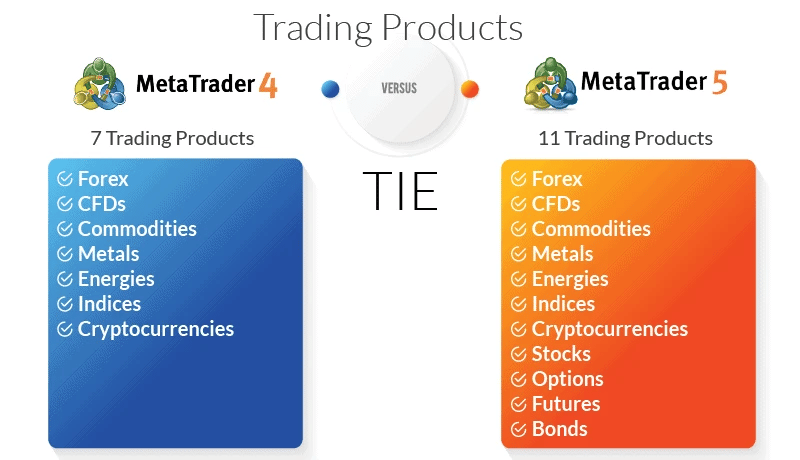

Asset Classes and Market Coverage

The scope of tradable assets differs significantly:

-

MT4: Primarily forex and limited CFDs.

-

MT5: Forex, stocks, commodities, futures, and cryptocurrencies. Multi-asset access allows portfolio diversification without multiple accounts.

Traders deciding MT4 or MT5 which is better should assess whether they intend to trade forex exclusively or multiple asset classes.

Broker Support and Compatibility

When comparing MT4 vs MT5, broker support is a crucial factor:

-

MT4 is supported by almost all forex brokers, including major platforms like Exness, OctaFX, and many others. Its widespread adoption means traders can easily find accounts, VPS solutions, and educational resources.

-

MT5 is gradually gaining adoption, with an increasing number of brokers offering it alongside MT4. However, some brokers still limit MT5 access, particularly for forex-only accounts. Checking compatibility with your preferred broker is essential before switching.

Practical tip: If your broker offers both MT4 and MT5, consider opening demo accounts on each platform to evaluate interface usability, order execution speed, and access to asset classes.

User Experience and Interface Comparison

User experience is another important differentiator:

-

MT4 features a simple, intuitive interface that is beginner-friendly. All essential trading functions, charts, and indicators are accessible without a steep learning curve. Its large community provides tutorials, templates, and shared Expert Advisors, which is helpful for new traders.

-

MT5 has a similar layout to MT4 but adds additional functionality. While slightly more complex, MT5’s interface supports multi-asset trading, overlays multiple charts, provides Depth of Market data, and includes more order types. Advanced users benefit from these enhancements, although beginners may need time to fully utilize the features.

For traders evaluating MT4 or MT5 which is better, user experience often comes down to comfort with interface complexity and whether multi-asset trading is required.

Migrating from MT4 to MT5: What You Need to Know

Many traders hesitate to switch from MT4 to MT5 because of migration concerns. Here’s what to consider:

-

Expert Advisors and Indicators: MT4 EAs and custom indicators are written in MQL4 and are not directly compatible with MT5, which uses MQL5. Traders must either find MQL5 versions or hire a programmer to convert existing tools.

-

Account Migration: MT5 supports multi-asset accounts, so some brokers may require a new account setup. For forex-focused traders who rely on MT4 accounts, dual platform use (running both MT4 and MT5) is possible.

-

Learning Curve: MT5’s additional timeframes, order types, and DOM features require some learning. Starting with demo accounts is recommended.

Practical migration strategy: Gradually transition to MT5 while maintaining MT4 accounts to ensure trading continuity. Evaluate your most-used EAs, indicators, and broker features before switching entirely.

Which Platform is Best for Different Trader Profiles?

Different trading profiles may favor MT4 or MT5:

-

Beginner Forex Traders: MT4 is ideal due to simplicity, straightforward order types, and abundant community support. Beginners benefit from readily available tutorials and pre-built EAs.

-

Advanced Forex Traders: MT5 offers extra order types, multiple timeframes, and faster backtesting, which can enhance sophisticated forex strategies.

-

Multi-Asset Traders: MT5 is superior, supporting stocks, commodities, futures, and cryptocurrencies in addition to forex. Traders can diversify portfolios without separate platforms.

-

Automated Trading Enthusiasts: While both platforms support EAs, MT5 features vs MT4 advantage lies in MQL5’s object-oriented programming and multi-threaded backtesting capabilities. This allows for more complex algorithms and multi-currency strategy testing.

Choosing MT4 or MT5 which is better depends on your trading goals, strategy complexity, and preferred asset classes.

Summary and Final Recommendation

Both MT4 and MT5 are robust trading platforms with their own strengths. Here’s a practical takeaway based on trader needs:

-

Choose MT4 if: You are a beginner, primarily trade forex, want a simple interface, or rely on existing community EAs. MT4’s large broker support, simplicity, and educational resources make it ideal for newcomers.

-

Choose MT5 if: You are an advanced trader, trade multiple asset classes, require more order types, advanced timeframes, or sophisticated automated strategies. MT5’s multi-threaded backtesting, Depth of Market, and object-oriented programming provide tools for professional traders.

For hosting considerations, MT4 VPS and MT5 VPS ensure stable and fast execution for automated trading.

Ultimately, MT4 vs MT5 which is better depends on your trading goals, desired assets, and comfort with advanced features. Beginners may start with MT4 and gradually explore MT5 as their strategies and multi-asset needs grow, ensuring a smooth and efficient trading journey.

![What Is Cold Data Storage? ❄️ [2026 Guide] What Is Cold Data Storage? ❄️ [2026 Guide]](https://1gbits.com/cdn-cgi/image//https://s3.1gbits.com/blog/2026/02/what-is-cold-data-storage-750xAuto.webp)

![What Is Virtual Desktop Infrastructure? 🖥️ [VDI Explained] What Is Virtual Desktop Infrastructure? 🖥️ [VDI Explained]](https://1gbits.com/cdn-cgi/image//https://s3.1gbits.com/blog/2026/02/what-is-virtual-desktop-infrastructure-vdi-750xAuto.webp)